RC Activities, Inc. Accounting Standards

Accounting / Banking Policies and Procedures

I. Introduction

- The purpose of this manual is to describe all the accounting policies and procedures currently in use at RC Activities, Inc. and to ensure that the financial statements conform to the Generally Accepted Accounting Principles(GAAP); assets are safeguarded; guidelines of donors are complied with; and finances are managed with accuracy, efficiency, and transparency.

- All the staff with a role in the management of fiscal and accounting operations are expected to comply with the policies and procedures in this manual.

- RC Activities, Inc. falls under the Regnum Christi Federation which is responsible for managing and overseeing the corporation’s accounting and infrastructure. These policies will be reviewed annually and revised as needed by the Regnum Christi Federation Administration Department and approval (if needed) by the Territorial Directive College.

- If you have any questions regarding the implementation of these standards, please contact the RC Activities, Inc. National Office at [email protected].

II. Accounting Standards

GENERALLY ACCEPTED ACCOUNTING PRINCIPLES

As nonprofit entities based in the United States, each corporation adheres to the United States -Generally Accepted Accounting Practices (US-GAAP) including those specific to not-for-profit entities (specifically FASB 116 and 117).

BASIS OF ACCOUNTING

As US GAAP requires, the accrual basis of accounting will be used. All income and expenses are recorded in the period in which they occur, not the period in which the cash is paid or received (cash basis).

FUND ACCOUNTING

Nonprofits use fund accounting. Fund accounting allows for separate record keeping for separate funds. Fund accounting facilitates the ability of apostolates to meet the requirement to classify funds into three net asset classes according to the existence or absence of donor-imposed restrictions (e.g. unrestricted, temporarily restricted, and permanently restricted.).

ACCOUNTING SYSTEM

QuickBooks Enterprise is the system used by the Regnum Christi Federation sections and localities.

It is important that the bookkeeper be someone that understands bookkeeping and accounting. RC Activities, Inc. needs to be an externally auditable corporation and as such, understanding the basic principles of bookkeeping is a requirement of the bookkeeper role.

USE OF CLASSES IN QUICKBOOKS

QuickBooks classes will be used to streamline the chart of accounts while allowing for individual accounting (P&L and B/S) of each cost center. The following are the standard cost centers (i.e. classes) in a section or locality. Additional classes may be requested by contacting the RC Activities National Office:

- RCM (Men Section)

- RCW (Women Section)

- RCYM (Young Men Section (if there is one))

- RCYW (Young Women Section (If there is one))

- ECYDB (Youth Boys)

- ECYDG (Youth Girls)

- RCA (RC Auxiliary Team (e.g. RC Houston))

- Gala

- Events

Other examples of classes (where you may want to produce a profit and loss):

- Bookstore

- Retreats

- Missions

- RCMC

USE OF SUB-CLASSES

Sub-Classes may be used to sub-divide the above classes, for example: in NY’s Tri-State locality, two sub-classes could be created under RCM, NYCT & NJ to better reflect how they are organized in the Tri-State locality. Under Events, possible sub-classes could be: Feast of Christ the King, Dinner for Priests or basically any event you would want to know how profitable it was or that has a budget owner.

III. Standard Chart of Accounts

- A Chart of Accounts has been designated specifically to the operational needs and the needs of the financial statements for RC Activities, Inc.

- The RC Activities National Office publishes the standard chart of accounts to be used in the USA. This territorial chart of accounts is designed to enable consolidation of financial information for reporting and comparative purposes.

- The RC Activities National Office is responsible for maintaining the Chart of Accounts, reviewing and approving new GL codes and revising as necessary. The RC Activities, Inc. Standard Chart of Accounts is listed at the end of this manual in Appendix III.

IV. Chart of Accounts Structure

- The QuickBooks RC Activities, Inc. standard chart of accounts has been mapped to territorial standard accounts in order to consolidate the financial statements at a Territory Level.

- The chart of accounts should not be modified or changed in any manner. However, subaccounts can be added and utilized under high level accounts.

- The RC Activities National Office provides annual required budget templates, that have examples of what items should be booked to specific accounts.

- See the standard chart of accounts in Appendix III for more details of high level and subaccounts.

V. Accounting Tool

- The accounting tool to be used by all sections and localities is QuickBooks Enterprise on the territorial server. The Chart of Accounts is designed to give the most flexibility to the section and locality while allowing the information to be imported by the territory for better nationwide consolidation and reporting.

- Adherences to these high level standards are critical for the smooth flow of information at the National level.

VI. Revenue Standards

REVENUE RECOGNITION

Revenue is recognized on an accrual basis, that is, it is recorded when realized or realizable. All revenue for the fiscal year should be recorded in that fiscal year, not when the payment is received.

In the case of a retreat, the revenue is recognized on the year the retreat was attended and not when the payment was received.

Discounts (such as retreat discounts, retreat assistance and scholarships) are recorded as a separate contra-revenue accounts, and not as expense accounts. For example, when recording income for a retreat the cost of the retreat should be posted to the income account associated with the retreat income account. The discount amount should be posted to a separate income account (Discounts which is a contra-revenue account) and will show as a negative amount when looking at the reports. This will give you the net revenue while showing clearly the income and the discount lines.

Revenue must be recorded by creating a Sales Receipt under donations in QuickBooks and correctly assigned the revenue to one of the following revenue categories:

1. SUPPLEMENTARY REVENUE

Revenue from activities of the organization including those associated with furthering the mission of the organization, e.g. stipends, events, unrelated business income, retreat fees, membership fees, subscriptions, etc.

2. DONATIONS

Donations are contributions made freely by the donor with no consideration. This means that the donor does not directly benefit from the transaction. For example, a “donation” to cover a specific individual retreat’s fee is NOT a donation as the donor chooses who receives the benefit, but rather this is simply a payment of accounts receivable. A donation to the scholarship fund does not directly benefit any specific individual and is therefore an acceptable donation.

Note that in order for a scholarship fund to be considered donations, scholarships must be awarded according to a formalized and documented procedure that explains the basis on which scholarships are awarded.

According to US GAAP, contributions can come in three major asset classifications: Unrestricted, Temporarily Restricted, and Permanently Restricted. To meet GAAP requirements, each entity must separate these funds.

When individuals give a priest money for celebrating a Mass, such money is a donation and not a stipend. As a rule of thumb, institutions (Parishes, Corporations, etc.) give stipends while individuals give donations. Donations are tax deductible but stipends are not.

a. UNRESTRICTED DONATIONS

Unrestricted donations are contributions made without any restrictions from the donor. They may be in response to a specific appeal, for example, for the annual fund, but are not legally bound by the donor for a specific purpose.

b. TEMPORARILY RESTRICTED DONATIONS

Temporarily restricted donations are donations that are legally bound by the donor. In this case, the donor specifically states that their funds have to be used for a specific project and cannot be used for any other concept. An example would be a donation meant for local Holy Week Missions. In this case, the donor is giving for the purpose of helping the local missions during the time frame of Holy Week. The funds would be maintained as temporarily restricted until the purpose is satisfied.

c. PERMANENTLY RESTRICTED DONATIONS

Permanently restricted items are also known as endowments. This means that the donor gives a lump sum of money of which the principal amount can never be used by the section or locality. However, the investment income generated by the account can be placed in operational income and used for the normal operational cash flow.

d. GIFT IN KIND DONATIONS

Gift in Kind donations are any gifts that are not in the form of a cash equivalent (cash, check, credit card). Any gift in kind should be valued based on the fair market value as of the date of the donation. For an instrument like a share of a stock, this fair market value is easy to determine. However, for an item that is difficult to determine, like a painting, professional appraisals may be required. Another example would be a gift card, which should be recorded as a gift in kind donation. For assistance in this area, contact the RC Activities National Office.

The recording of the transaction should take place when the item is received from the donor, not when the item is sold for cash (if applicable). The transaction would be a debit to the proper asset account (equipment, investments, etc.) and a credit to the proper donations revenue account.

e. STOCK DONATIONS

Stock donations are processed through the Legion of Christ, and immediatly liquidated, and funds are sent to the appropriate restricted locality/section/program. The tax-acknowledgement letter however is processed and sent from the receiving entity (RC Activities, Inc. locally).

See Appendix II - #8 for Tax Acknowledgements

3. OTHER REVENUE

All other revenue should be recorded on an accrual basis. For revenue like bookstore income or merchandise sale income, the revenue is recorded when the cash is received (accrual and cash basis are the same in this case).

For any revenue types that are not cash basis, accounts receivable should be used. For example, if the section or locality sub-leases space to a third party on a monthly basis, the revenue should be recorded on the first of each month with a debit to accounts receivable and a credit to facility rental fees. When the funds are collected the process is to go to receive payments module and this will decrease the A/R listed on the balance sheet.

4. ALL DEPOSITS

All deposits recorded must have an accompaning support document such as a record of individual online sales, actual copy of check(s), or sales receipt(s). These documents must be kept orderly with the total deposit amount and retained for a period of 7 years per GAAP requirments for all accounting documentation.

VII. Expense Allocations

EXPENSE CATEGORIES

Expenses must be correctly assigned to accounts within one of the following categories:

- Expenses – All expenses associated with the operation of the section or locality.

- Financial expenses - Interest payments to be made against financial loans secured for capital projects or operating lines of credit.

EXPENSE RECOGNITION

Expenses should be recognized on an accrual basis. For most expenses, this means the use of an accounts payable system.

Expenses should be recorded as of the date the service was provided or when the product was purchased. In most scenarios, this means recording the transaction as of the invoice date. The exception to this is when you are trying to enter an invoice from a closed period (a past month in which financial reports have been submitted). In this case the recommendation is to enter the invoice in the current period and make a memo noting that the correct month invoice should have been recorded.

Insurance payments should be held in Prepaid Expense and expensed January of the next fiscal year.

LEASE OF FACILITIES AND LEASEHOLD IMPROVEMENTS

If you are planning on making improvements to your facility or to lease a facility, please contact the RC Activities National Office prior to your project for approval.

PURCHASING AND PAYABLES

The purchase of goods and services must follow the following guidelines:

- The purchase of goods and services approved in the budget do not require locality (RC Local Director) approval prior to the purchase being made or the services being rendered.

- An authorization for expenditure is required for the purchase of any non-budgeted goods or services (e.g. not included in the budget, or in excess of budgeted amount)

- An authorization for expenditure is required for the purchase of any budgeted or non-budgeted good or service by an employee using their own monies to be reimbursed upon completion of an Expense Claim Form

- An authorization for expenditure is required for the purchase of any budgeted or non-budgeted good or service in excess of $5,000

- Invoices, check requests or expense claims related to purchases made must be submitted to your business office/accountant/bookkeeper by the 5th of the following month for timely processing. There will be a maximum of a four-week turnaround once received by the business office.

- Vendor payments and expense reimbursement may not be processed or paid without all required approvals and applicable backup documentation.

- For events, it is up to the section or locality to determine if all expenses are booked under "events" or if they are broken out by type of expense on the chart of accounts. It depends on where the expenses were originally budgeted, as well as the use of classes.

PREPAID EXPENSES

A prepaid expense is an expense paid for in one accounting period, but for which the original asset will not be consumed until a future period. Examples of prepaid expenses are:

- Insurance

- Prepaid Rent

- Deposits

These type of prepaid expenses are paid in advance for multiple future periods. The bookkeeper should initially record this expenditure as a prepaid expense (an asset on the balance sheet) until it is consumed and when the asset is eventually consumed, it is charged to an expense account.

VIII. Annual Budget

ANNUAL BUDGET PROCESS

- Annual Locality Roll-up Budgets are due on September 30th each year for the following year. They must be sent in the required template format which can be found at https://rcactivities.com/planning. There are also useful planning tools and section budget templates available.

- Annual locality budgets are submitted through the Regnum Christi Federation Administration office, and are reviewed and approved by the Territorial Directive College by December each year.

- Annual budgets will be entered into QuickBooks by January 15th and after approval at the end of the planning cycle, by account, by month.

- Please see the Planning and Budget Support Page for further information.

IX. Internal Controls

Internal Control Policies protect the assets of the Corporation, both local and national. They represent a series of checks and balances. The following checklists provide guidelines for internal controls with cash.

CASH RECEIPTS

- Separation of Duties – to the extent possible:

- Open Mail

- Bank Deposit

- Post G/L Transaction

- All Checks Immediate Restrictive Endorsement Stamp “FDO”

- All Checks and Bank Deposit receipts photocopied or scanned, and filed

- Same day Bank Deposits

- Reconciliation of cash receipts journal with Bank Deposit

- Same Day Deposit Posting to General Ledger

- Periodic Management Review

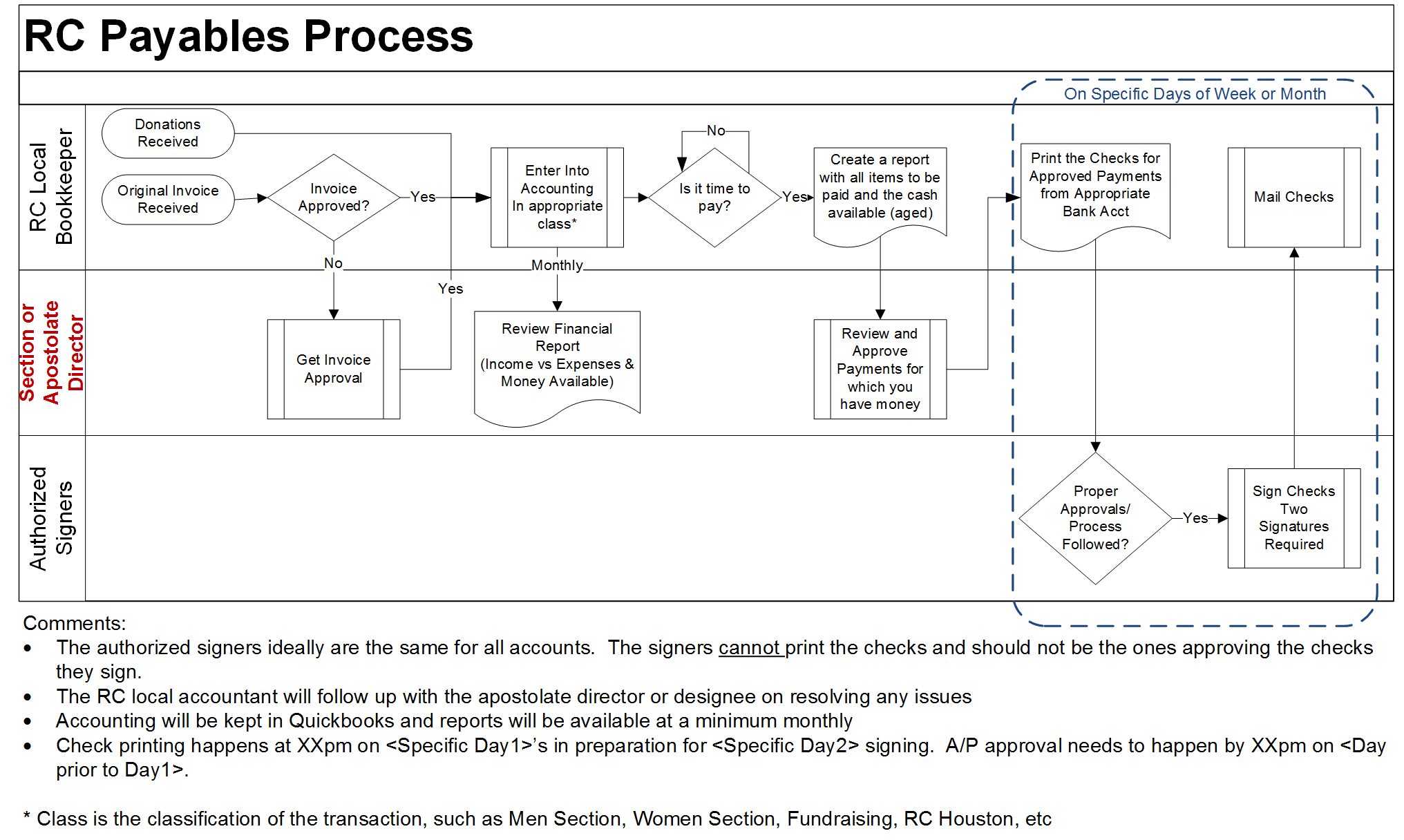

CASH DISBURSEMENT

- Separation of Duties:

- Check Preparer/Recording

- Authorized signers.

- The check signers should be someone other than those that have the ability to record the checks in QuickBooks

- Payment Approvers

- The section or apostolate director is responsible for approving all expenditures/payments.

- Check preparer/bookkeeper/accountant should not have check signing authority.

- Use of pre-numbered Checks (ideally laser checks with vouchers that can be printed vs. hand written)

- Voided Checks marked “VOID”, signature torn-off

- Corporate Checks payable to “Cash” or “not-Bearer” for petty cash, cash advances, etc.

- Authorized Check Signatories

- no G/L posting Responsibilities

- Must not sign blank checks

- Voucher/Documentation presented at signature request

- Periodic Management Review

- Petty cash should not to exceed $500

BANK ACCOUNTS

- All cash transactions and bank reconciliations must be reviewed and signed approved by the RC Director.

- Separation of Duties: Check writing, check signing and payment approval. The Secretary of the Corporation will be a signer on every account, see the appendix “Treasury Functions”

- Unused bank accounts closed, notification in writing

- Unused Checks for closed accounts destroyed

- Bank Notification in writing for Signature changes

- All bank fees properly booked each month

- Check Number sequence accounted for with reconciliation

- Canceled Checks Examined for:

- Date, Name, Authorized Signatures, Cancellation, Endorsement

- You may have one account for all local business for each of the following

- Regular Expense Account (one account for all sections and programs)

- All checks/payments are made from this account

- Capital/Investment Account (RC Activities National Office can process any stock donations on your behalf)

- Payroll Account. The RC Activities National Office maintains one payroll account for the corporation. Contact our office well in advance if you are planning to hire a contractor or employee. The requirements are that you keep minimum 3 payrolls in reserve in the payroll account at all times. (see appendix II #5.)

- Regular Expense Account (one account for all sections and programs)

PETTY CASH ACCOUNT

The entity can maintain a petty cash up to $500. Specific events could have higher amounts. All funds in and out of petty cash must be tracked in a register (each event needs their own), and receipts for expenses must be retained, signed by the users and their supervisors. All expenditures should be pre-approved.

EMPLOYEE or VOLUNTEER REIMBURSEMENTS

All reimbursements must be submitted using the RC Activities, Inc. Expense Report Template. All receipts must be turned in with the expense report, and the employee/volunteer and supervisor must sign the report before a reimbursement check is submitted. These expense reports must be filed (along with applicable receipts). Under no circumstances are funds to be given to ANY individual without documentation, as RC Activities, Inc. is a non-profit, and by IRS law unable to provide funds to any individual.

X. Month End Close

REQUIREMENT DATE

Month-end closing should be completed by the 10th day of the month, unless the 10th falls on a weekend or holiday. In that case, the previous business day would be the month close. The following steps should be completed before submitting all the financials.

MONTH END FILES

- All expenditures receipts, invoices, purchase orders and expense reports must be filed by category or in a month end folder.

- Bank statements and reconciliations reports must be also filed.

- It is a good practice to keep all backup documents in a hard copy and in an electronic copy.

- The files should be kept for at least 7 years per RC Activities, Inc. record retention policy.

BANK ACCOUNT RECONCILIATION

All cash activity for the month on the G/L (all cash and bank accounts) must be reconciled with the monthly activity from the Bank Statement.

The Bank reconciliations should be completed for the following account:

- Centralized Deposit Bank Account

- Expense Bank Account

- Petty Cash Account

- FBC Bank Accounts

- Prepaid Cards Account

Bank Reconciliation reports should be attached to month end bank statements for all these accounts.

BUDGET TO ACTUAL RECONCILIATION

A review of budget vs actual for the month being closed and year to date results (P&L) need to be validated with the Section Director and/or RC Local Director.

Administrators to notify the RC Activities National Office of any budget change requests after approval from the Section Director or Local Director.

- STATEMENT OF FINANCIAL POSITION

- Review and print the month end balance sheet.

- Submit the Balance sheet report to the Section Director and/or RC Local Director.

- YTD STATEMENT OF FINANCIAL ACTIVITIES

- Review and print the month end Profit and Loss

- Submit the P&L report to the Section Director and/or RC Local Director.

- SETTING A CLOSING PASSWORD IN QUICKBOOKS

- Once the previous month is closed, and all reports are completed and signed off, you should set the monthly closing password for the previous month. This ensures that no entries can be made in the past period, which would change all the previous financial reports. Journal entries in the current period should be used.

XI. Management Reports

FINANCIAL STATEMENT REQUIREMENT

Quarterly

Quarterly Financial Statements should be produced at the end of each fiscal quarter by the 10th day of the month. These should include a quarterly P&L Standard (actuals vs. budget) and Balance Sheet at the bare minimum. These should be sent to the account owner, RC Local Director and the RC Activities National Office with any pertainent notes. These reports should be kept on file locally in print and electronically.If you will not be able to close your books by the deadline, you should notify your RC Local Director via email as soon as it is known to avoid consolidated reports and analysis being done on incomplete/incorrect information.

End of Fiscal Year

A complete year end review of all financials should be completed by the bookkeeper and account owner. Once any and all changes are made, and the books can be closed for the year, a year end financials statement should be ran and provided to both the RC Local Director and the RC Activities National Office. This report should be kept on file locally in print and electronically.

APPENDIX II - Treasury Functions

1. When is a bank account needed and justified to have it opened?

- For a locality to operate under RC Activities they will need to have a bank account under RC Activities.

- Care should be taken with the proliferation of bank accounts. A locality should try to minimize the number of bank accounts it has.

- Every bank account needs to be reconciled monthly and incurs monthly cost. Each user of the bank account would be responsible to pay their own banking fees; they would be automatically drawn every month. This is why it is very convenient to consolidate bank accounts as much as possible and not to open them for a “once in a year” event or purpose, like an Annual Gala or a Summer Camp. With proper accounting and controls a locality should be able to minimize the number of accounts it is responsible for.

2. In which banks do we open bank accounts?

Currently RC Activities allows for each locality to choose the bank of their choice. (All except Wells Fargo may be used). Limiting the use of just one bank per locality (for all sections) is ideal, especially when the moment arrives to have external audit for this corporation, it would be easier to manage if the number of banks we do business with is small in any given locale.

3. Requirements for a signer

- All RC Activities, Inc. account signers and bookkeepers must be certified through the RC Activities, Inc. Volunteer Certification Process. (https://rcactivities.com/volunteers) prior to opening a new account or being added as a signer to an existing account.

- The RC Activities, Inc. corporation reserves the right to have the Secretary of the Corporation on every account in order to facilitate banking at the corporate level.

- RC Activities will not exercise its signature authority without approval of the account owner and/or the Section Director or Local Director if owner not available.

- The approval must be properly documented (e.g.: email)

In the case RC Activities exercises its signature authority without approval, the account owner, Section Director or Local Director would raise the issue to the Territorial Directive College (RC Activities, Inc. Board of Directors) for remediation and restitution.

4. Process to request a new bank account

- The RC Local Director must first approve locally a new bank account request.

- Once approved, the owner must send a request to the RC Activities, Inc. National Office via email at ([email protected]).

- Information will need to be provided from the owner, such as Bank name, full mailing address, phone number, as well as signers to be listed on the account. QuickBooks Enterprise user setup information is also gathered at the same time.

- The owner will directly work with the RC Activities National Office to receive authorization documents from the Secretary of the Corporation to take to the local bank to open the account.

- Allow at least 4-6 weeks in process (depending on bank) for new account openings.

- It is up to the local owner to pay the local bank fees, charges, as well as request/setup online access.

- For existing bank accounts that needs a change of signers, please contact the RC Activities National Office. Although in most cases this can be done locally, any updated corporate record must be reported each time there is a change made.

5. Locality Payroll – hiring employees under RC Activities, Inc.

- Payroll is setup nationally under RC Activities, Inc. for any locally hired part time or full time employees.

- The position must be first approved through the locality and the Local Director.

- Information must be provided as to the nature and responsibilities of the job. (complete job description). The RC Activities National Office will work with the CCAS HR department to setup a recommendation for the title, job grade, minimum and maximum hourly or salary for the particular position (based upon the region in the USA). The new hire must also go through a background check screening process. These must be adhered to.

- A State payroll account will be setup for payroll tax deductions, as well as an account on PayLocity.com, the RC Activities, Inc. payroll provided (required).

- An escrow account must be established for the locality (or individual section) with a minimum of 3 months of payroll to be sent to the National Office before the new hire works their first day. This account is maintained and managed by the RC Activities National Office. ([email protected])

- Hourly employees must clock in and out using the provided PayLocity.com system, and managed locally by their supervisor.

- Payroll is always processed 1 week behind actual working hours, and a bi-weekly pay schedule.

- The payroll escrow account is automatically drafted the Thursday before each Friday bi-weekly payroll period.

- At the end of each month, an invoice will be sent to the section or locality for the previous month’s accrued payroll cost including gross salary, employer taxes, healthcare and benefits. The invoice payment is due promptly the 15th of the following month.

- The escrow account will fluctuate monthly from 1.5 to 2 months of funds availability if the invoices are paid on time.

- If invoices are past due, the locality or section will be notified, and a notice will be given to rectify the funding or to stop payroll if funds are not available for the bi-weekly draft.

6. Contractor / Consultant / Professional Services

- Contractors may provide their own contract or RC Activities; Inc. can provide one. (legal templates are available from the RC Activities National Office)

- Only an authorized corporate representative nationally may sign any RC Activities, Inc. contracts. ([email protected])

- The contractor must provide an IRS-W9 form completed and signed.

- If the contractor is an individual or an LLC (Limited Liability Company), they must be setup in Quickbooks Enterprise as a 1099-vendor.

- Any contractor paid $600 or more in a fiscal year must receive a 1099-MISC form in January the following year per IRS guidelines. The bank account holder must provide the RC Activities, Inc. national office with the 1099 information no later than Jan 10th each year. The national office will process the 1099-MISC forms, as well as combine and file all localities 1096 forms with the IRS as a corporation.

7. Use of Merchant Accounts / Online tools

- Localities have the option to choose which merchant service provider. There are some preferred and approved providers such as:

- Stripe

- Acceptiva

- PayPal (this option is least preferred, as the fees are the highest and very hard to receive non-profit approval from PayPal which is required to avoid taxes on revenues received)

- These accounts must be requested and setup under the guidance of territorial administration, as they are essentially treated as bank accounts to receive and send funds linked to an RC Activities, Inc. bank account.

- Any new merchant account requested must be approved by the RC local director.

- Use of Venmo is prohibited. Receiving and sending funds through "friends and family" is not legal for any business. Venmo is offering a business platform, but it is not yet approved at this time.

- Accounts setup under an individual name on their own rather than RC Activities, Inc. through our administration office may be personally liable for taxes on reveune received on a 1099-NEC IRS form.

8. Formal Tax Acknowledgement Letters

- Tax acknowledgement letters are issued centrally by the RC Activities National Office for any donation (per IRS guidelines) of $250 or more in a fiscal year. There are two exceptions:

- Use of online donation forms, where a donation is paid online, and the system (such as Acceptiva, RC CRM, or PayPal, etc. automatically sends an email which includes a receipt with the required IRS recognition of the donation.

- Permission is granted from the RC Activities National Office to certain localities to produce their own tax acknowledgement letters if they meet certain criteria. The locality can choose to process them according to their procedures and timeline, which may be monthly, quarterly, or annually, as long as it fulfills the IRS requirements to mail all acknowledgements no later than the end of January for the previous year receipts.

- Process for requesting tax acknowledgement letters from the RC Activities National Office:

- Quarterly, send copies of the actual donation checks to [email protected]. For donations made online that were not automatically acknowledged by an email, send the following information for each donation: Full name, mailing address, amount of donation, date of donation, and a reference code for the transaction.

APPENDIX III - RC Activities, Inc. Standard Chart of Accounts

|

INCOME |

|

|

Operational |

411009 · OTHER OPPERATIONAL INCOME |

|

|

4110140 · Supplementary Revenues (Events) |

|

|

TOTAL OPERATIONAL |

|

Other |

411011 · OTHER INCOME |

|

|

4220010 · Other Revenues (Financial Income) |

|

|

TOTAL OTHER |

|

Donations |

420001 · OPERATIONAL DONATIONS |

|

|

4130000 · Donations Receipt Affiliates (from other sections) |

|

|

4130010 · Donations Received (general, Gala) |

|

|

4130011 · Gift In Kind Donations (gift or gas cards) |

|

|

TOTAL DONATIONS |

|

TOTAL INCOME |

|

|

EXPENSE |

|

|

Payroll |

610500 · PAYROLL EXPENSES |

|

|

6105140 · Other Payroll & Taxes |

|

|

TOTAL EXPENSES |

|

|

610503 · INDIRECT EMPLOYEES BENEFITS |

|

|

6105040 · Indirect Health care benefits |

|

|

6105100 · Indirect 401K match |

|

|

6105110 · Indirect FICA taxes |

|

|

TOTAL BENEFITS |

|

|

TOTAL PAYROLL |

|

Communications |

611700 · COMMUNICATIONS |

|

|

6117010 · Phone |

|

|

6117020 · Communications Links |

|

|

6117030 · Mail & Courier (Postage) |

|

|

TOTAL COMMUNICATIONS |

|

Admin |

612007 · ADMINISTRATIONS SERVICES |

|

|

6120070 · Administration Services |

|

|

TOTAL ADMIN |

|

Professional |

612008 · PROFESSIONAL FEES |

|

|

6120081 · Professional fees |

|

|

TOTAL PROFESSIONAL |

|

Training |

612501 · INDIRECT TRAINING (Member formation) |

|

|

6137011 · Training |

|

Travel |

612502 · INDIRECT TRAVEL EXPENSES |

|

|

6125020 · Air Travel |

|

|

6152010 · Car Fuel |

|

|

6152030 · Other Transportation Expenses |

|

|

TOTAL TRAVEL |

|

Maintenance |

612701 · MAINTENANCE |

|

|

6127010 · Facility & Equip Maintenance |

|

|

613201 · EXTRAORDINARY MAINTENANCE |

|

|

6132011 · Major Maintenance Needs |

|

|

TOTAL MAINTENANCE |

|

Insurance |

613701 · INDIRECT INSURANCE |

|

|

6135010 · Personnel Insurance |

|

|

6137010 · Real Estate Insurance |

|

|

6137040 · Public Liability Insurance |

|

|

TOTAL INSURANCE |

|

Rental |

614001 · PROPERTY RENTAL |

|

|

6140010 · Property Rental |

|

|

6140030 · Automible Leasing/rental |

|

|

TOTAL RENTAL |

|

Office |

614201 · OFFICE MATERIAL |

|

|

6142010 · Stationery and Office Supplies |

|

Events |

614701 · EVENTS |

|

|

6147011 · Events / Conventions / Galas |

|

|

TOTAL EVENTS |

|

Recognition |

614702 · CULTIVATION & RECOGNITION |

|

|

6147021 · Recognition / Awards |

|

|

TOTAL RECOGNITION |

|

Bank Fees |

616003 · BANK FEES |

|

|

6160031 · Bank charges |

|

|

TOTAL BANK FEES |

|

Donations Granted |

616501 · DONATIONS GRANTED |

|

|

6165000 · Donations granted to Affiliates (LC Community) |

|

|

Donations granted to Affiliates (Consecrated Community) |

|

|

Donations granted to Affiliates (Territory) |

|

|

TOTAL DONATIONS |

|

Licenses |

621004 · RIGHTS & LICENSES |

|

|

6157050 · Rights Payment |

|

|

6157070 · Registration & Licenses |

|

|

TOTAL LICENSES |